China: sleeping giant rapidly awakens

China is one of the largest feed producing countries in the world, importing plenty raw materials for feed. The development of the Chinese feed industry cannot be separated from the world, and the development of the global feed industry relies on China. A healthy development of the feed industry in this country will surely make a significant contribution to the development of the global feed industry.

China

modern animal husbandry and aquaculture development. The feed industry in China

began its

|

development toward the end of

the 1970s, and after more than 20 years of growth and vigorous

development, has effectively transformed back yard farming towards intensified

and modern livestock production. The country has also made great contributions

in satisfying the needs for protein by the general public, facilitating the

readjustment of the Chinese agricultural structure, prospering the rural economy

and increasing farmers’ income. This tremendous achievement has, in turn,

attracted worldwide attention.

The output of Chinese feed products has

maintained stable and rapid growth. Between 1980 and 1990, the overall output of

feed across the country gained an annual increase rate of almost 30%, and

between 1990 and 2000, the annual increase rate was more than 10%. From 1996,

the total feed production in China ranked second place in the world (after the

US). In 2005 alone, the production value of the feed processing industry

|

| There are over 15,000 feed millers in China, but the top 10 companies manufacture 21% of the total output and the first 30 make up 40% of total output. (Photo: Xuyi) |

stood

at 274.2 billion yuan (€26.36 billion), while the output for industrial feed

reached 107 million tonnes. Between 2000 and 2005, the annual increase rate of

outputs for industrial feed, compound feed, concentrated feed and feed additive

premix was 9.5%, 7.7%, 18.9% and 16.8% respectively. As the backbone of the feed

industry, feed additives have also made remarkable progress.

with the total production increasing from 78,000 tonnes in 2003, to 336,000

tonnes in 2005. Vitamin and mineral feed additives can basically satisfy the

needs of domestic markets with some volume being exported to foreign

countries.

in facilitating a healthy development in the international feed industry.

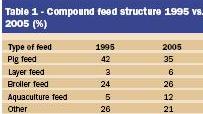

The increasing rate for compound

feed, concentrated feed and feed additive premixes has remained on a high level.

The proportion of compound feed has seen a small decrease, while the proportion

of concentrated feed and feed additive premixes have increased with product

structure being matched more closely with the demands of the Chinese livestock

industry. The production of compound feed for aquaculture and ruminant

concentrated feed supplements have been increasing more rapidly than other

feeds.

data):

• East – 10 provinces, 48.61 million tonnes (45% of total)

• Middle

– 6 provinces, 24.58 million tonnes (23%)

• Northeast – 3 provinces, 14.76

million tonnes

(14%)

• West – 12 provinces (no statistics from Tibet),

19.38

million tonnes (18%).

experienced the attack of highly pathogenic avian influenza (bird flu) and

Streptococcus suis

pig disease,

as well as a big rise on raw material demands. The risk awareness of feed

enterprises has since been enhanced. The industry has also become more mature

and, in terms of production and profits, has steadily increased. It can

therefore be said that the feed industry in China has transformed from

volume-specific to both volumeand quality-specific.

Law and regulation systems have

gradually improved and the industry has maintained healthy development. The

Chinese government has always paid much attention to the safety of feed and,

since 1999, has formulated and implemented the “Regulations for Management on

Feed and Feed

|

Additives”, formulating a series of normative law

documents.

With the application of science and

technology, feed conversion rate has been greatly improved with raising cycle

shortened and efficiency enhanced. Feed science, technological innovation and

science transformation have become the main reasons for promoting sustained and

healthy development of the industry, animal husbandry and aquaculture. Through

diversified merger activities, the number of feed enterprises has decreased,

while produced volume per enterprise has increased. In 2004, the number of feed

enterprises, with an annual output of over 100,000 tonnes, reached 70. The top

10 feed enterprises produced more than 20% of the total output of the

country.

China has proactively taken part in

international competition. At the beginning of reform, CP Group of Thailand and

other foreign large-scale feed companies have entered into the Chinese market.

Now, after more than 20 years of vigorous growth and development, some of

China’s feed

products hold a strong position in the competitive international

market. The market share of feed grade vitamin A, E and C accounts for 30-50%.

The use of L-Lysine is no longer dependent on imports, and China even exports

some of its products.

have been close to the international level, with export volume of feed

processing equipment increasing year by year, which has been warmly welcomed in

the Southeast Asian region. A group of feed processing enterprises have invested

in running feed processing companies in this region. These companies have the

ability to participate in international competition. The feed industry in China

as a whole has sound development, however, since the first three months of 2007,

the industry has experienced a decline in output due to the impact of bird flu.

A decrease in the overall income of animal husbandry has also been evident. Feed

enterprises are facing severe challenges, but, according to market experts, the

situation will change from the second half of this year.

The Chinese

government has attached great importance to the healthy development of the feed

industry and has released guidelines and recommendations in relation to the

industry’s growth and development, as

| |

| The Chinese feed industry is catching up rapidly. (Photo: Xuyi) |

well as given proactive support in terms of national budget,

taxation and finance. China has exempted feed processing enterprises from value

added tax, and even before 1994, feed enterprises had been exempted from income

tax, thus safeguarding the feed industry as one sector which supports

agriculture to move towards healthy development. The introduction of the (free)

market mechanism is the fundamental reason for the rapid growth of the feed

industry which, in China, has benefited from the reform and opening up in 1970s,

as well as the establishment of the socialist market system. The Chinese leader

of second generation, Deng Xiaoping, pointed out as early as in 1983 that “feed

should be operated as an industry, and this would be a big industry”.

“mass participation”, and operated in a diversified manner, such as

multi-element investment, market-driven operation system, commercialisation of

key technologies, enterprise group development and standardising of sector

management. The role of labour, knowledge, technology, management and capital

has been brought into full play.

Privately owned enterprises under

severe market competition have finally come into being and have occupied most of

the Chinese feed industry, which has become one of the sectors that have enjoyed

the highest development towards market operation. The China Feed Industry

Association (CFIA) has played an important part in this by strengthening

professional ethics and promoting its development. CFIA, established in 1985

after the approval by the State Council of the People’s Republic of China, was

the earliest industry association in the country with its function of

intermediary and professional ethics management, which links government and

enterprises. The Association takes a proactive role in the formulation of laws,

regulations and development programmes in relation to feed.

Although achievements have

been made, the feed industry in China still faces some constraints and new

challenges. Firstly, due to the increasingly demand for animal products and the

improvement of the commercialisation and degree of scale of production for

animal husbandry, there is still a big demand for some raw materials for feed.

Fish meal, an important animal protein feed, still relies on imports with annual

import volumes reaching 1 million tonnes. About 70% of soybeans for meal

production need to be imported with annual imports reaching 20 million tonnes.

The resources of protein feed in China will face a long-term shortage

situation.

regions with unbalanced growth. In China, there are currently 15,000 feed

enterprises, of which 2,800 enterprises produce more than 10,000 tonnes of feed

annually. There are 77 enterprises with annual production of more than 100,000

tonnes. The feed enterprises in the west operate on a relatively small-scale

with rather backward management means.

In the long-term, the

Chinese feed industry will establish a safe, qualitative and highly efficient

production system, and create a new type of industrialised path through sound

science and technology, good economic returns, low resource consumption and a

less polluted environment in order to realise a harmonised and coordinated

development for safety, quality

| |

| Sha Husheng: The Chinese feed industry still faces some contraints and challenges. (Photo: Dick Ziggers) |

and high efficiency. A balance between

supply and demand will also be ensured, as well as quality and safety. Industry

structure will be optimised, international competitive edge for feed enterprises

enhanced, and the laws and regulation system for feed will be further completed

and improved. In order to adapt to the trend of a more intensified livestock

industry, feed manufacturers will accelerate the development of concentrated

feed, concentrate supplementation and feed additive premixes to realise a

diversified feed system and multiple feed structures. The sector is expected to

proactively develop new types of feed resources and varieties, and accelerate

the updating of feeds with the aim of satisfying the needs for feed products for

different livestock varieties and methods.

By doing so, the CFIA realises

that it needs to implement and improve the system of production permit and press

ahead for GMP and HACCP safety management systems among feed enterprises with

the aim of maximum reduction of risks. The industry should accelerate the speed

of integration and updating level for feed enterprises, proactively

implement brand strategies to create a group of “Chinese Brands” and support a

number of feed enterprises with international competitive strengths, thus giving

imputes to the development of medium- and small-scale enterprises so as to raise

the modernised level of the Chinese feed industry.

- This is an edited version of a paper prepared by Yang Hongjie and

presented by Chinese feed industry representative Sha Husheng at AFMA-forum in

Sun City, South Africa.

11.7

Join 26,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the feed sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht