Global economy in bottoming out phase

ABN-AMRO in their Quarterly Commodity Outlook expects the global economy to bottom out, helped by the easing of financial conditions and some ebbing of uncertainty.

“It looks like the global cycle has turned, with momentum no longer deteriorating. We think that the global economy will now gradually get back on its feet, but there are reasons to think that the coming recovery will be rather moderate,” analysts of the bank report.

Breaks on the pace of recovery

The authorities in most big emerging markets have been rather cautious in putting in place monetary and fiscal stimulus, with the exception of Brazil, where policymakers have been aggressive.

The People’s Bank of China and Reserve Bank of India have eased policy only modestly. China has announced a fiscal stimulus, but it is multi-year and will have rather small effects in the coming quarters.

The Chinese authorities continue to have one eye on re-balancing the structure of the economy.

The global economy is bottoming out and a moderate improvement should become visible in coming months, ABN-AMRO said.

“We have a constructive outlook on the US economy and on emerging markets. However, growth in the eurozone will remain weak. For the Chinese economy we see stable growth in 2013.

“Even though our macro outlook will be supportive for commodity prices, we don’t believe in another bull-run,” the analysts state.

They have several reasons for this:

- China has moved to a lower growth speed and is transforming its economic growth model from being investment-dependent to being more driven by consumer demand. Although commodity demand will continue to rise, the pace will not be quite as strong as during the last few years.

- The market was quick to anticipate further easing of monetary policy so its effects are already largely priced in.

- Economic growth outlook is to be supportive but the modest improvements are not significant enough to support a surge in commodity prices.

- The bank remains constructive on the US$ and

- The supply/demand situation for most commodities is either in balance or points towards oversupply.

Agriculture

Soybean, corn and wheat prices have all fallen after reaching a high in August. Increasing demand will cause prices for soybeans and wheat to rise again. Same for corn, where low stock ratios also factor in.

Due to current high prices, a lower quantity of corn will be used in making ethanol, as importing Brazilian ethanol becomes a viable alternative in the US.

In short the outlook for:

Wheat

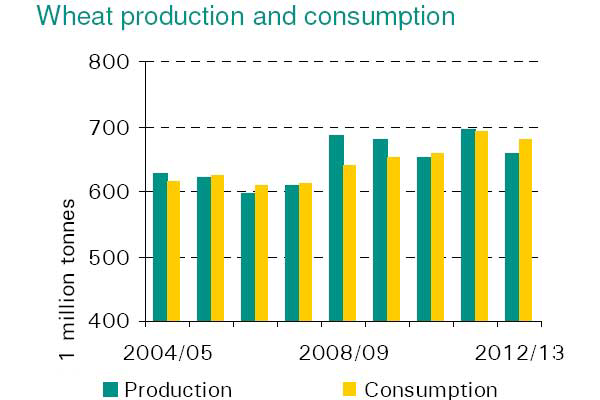

- Uncertainty and negative outlook for harvests worldwide keep prices high

- Demand remains at higher-than-usual levels and outstrips production

- In the short term, prices will remain high; in the course of next season they are likely to decline

Corn

- Lower projected demand has eased prices after August high

- Initial harvest figures, while still below forecast levels, better than feared

- Historically low stock-ratios will continue to affect the market

Soybeans

- Promising harvest outlook results in a slight price decline

- Production of biodiesel, in particular, puts heavy pressure on supplies

- Continuing increase in demand will support a further price rally in the near future

See attached pdf for full report