Industrial Compound Feed Product

The feed industry in the United Kingdom is dominated by two national compounders, a few country compounders and several co-operative compounders. The independent manufacturers have about a 43% market share and the cooperatives and nationals together take 57%. Annual production in 2005 averaged 13.6 million tonnes, coming down from 14 million tonnes in 2004.

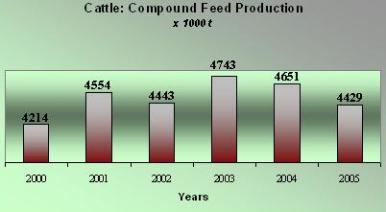

Total annual feed production shows a quite regular figure,

circling around 13.7 million tonnes in the last five years. Production peaked in

2004 with a little over 14 million tonnes, but came down to 13.6 million tonnes

last year mainly due to losses in cattle feed and poultry feed.

| Source: Fefac |

Compound feed production for cattle increased between 1974

and 1983. This increase was influenced by the financial incentives for dairy farmers to

produce as much milk as possible, thereby requiring large volumes of feed for their

cattle.

However, in 1984 the European Union, under

the Common Agriculture Policy, introduced milk quotas, designed to curtail

over-production. Milk producers stopped feeding their cows so much compound

feed, because it was no longer profitable for them to maintain the existing high

levels of milk production. The number of dairy cows also fell, by 10.7% between

1986 and 1990, after which there was only a slight drift downward. The total

cattle population declined from an annual average of 12.9 million between 1984

and 1986 to 11.7 million in 1995. One major factor here was the BSE crisis

.

The drop in demand for cattle feed was partly offset by

increased demand for feed for other animals. At its lowest point, in 1991, total

compound feed usage was only 4.4% below its 1982-84 annual average. Since 1991

there has been a slow increase in demand.

Cattle feed in the UK is dominated by feed for dairy cows,

taking around 66% of total cattle feed production. Feed for beef cows averages

to 28%. Cattle feed as a whole takes 32% of total UK feed production.

| Source: Fefac |

Pig production occurs in most areas but is prevalent in eastern

and northern England to take advantage of cereal production, which forms the

basis of pig diets. The cereal diet is supplemented with protein from vegetable

and animal sources, and with minerals and vitamins. Pig producers feed their

pigs home-mixed rations prepared on farm or purchased from a feed compounder.

Although bacon is still a big issue at UK breakfasts feed for

pigs represents only 12% of total feed production. The volume is still declining

and in five years time has come down almost 25%. In 2005 a little over 1.6

million tonnes of pig feed was produced, with feed for fatteners taking the

major portion (66%).

| Source: Fefac |

A particular feature of the poultry industry, setting it apart

from other livestock industries in the UK, is its vertical integration. Around

85% of poultry meat producers and 66% of egg producers are ‘integrated’. This

means that they control all stages of production from birth to slaughter of

broilers or layers, including breeding, fattening, and the production of animal

feed for their livestock.

Poultry feed is the major feedstock in the UK. It can be split

up in feed produced for integrated production and for independent poultry

production, where integrated production has a little over 50% share of total

poultry feed production. In 2005 some 6.3 million tonnes were produced (3.5

million tonnes broiler feed and 1.8 million tonnes of feed for laying hens),

which represents 46% of total feed production. In 2004 this figure was 6.4

million tonnes. The reduction of almost 200,000 tonnes comes fully to the

account of broiler feed, probably due to bird flu problems in Europe.

| Source: Fefac |

For more detailed information see Defra

Join 26,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the feed sector, three times a week. Beheer

Beheer

WP Admin

WP Admin  Bewerk bericht

Bewerk bericht