US feed report shows strong demand and high circular feed use

A new report about feed ingredient consumption in the USA shows that the demand for feed is strong, and while it has declined slightly over the past few years, use of circular feed is still very high. The new Feed Ingredient Consumption Report published by USA-based organisation IFEEDER contains many interesting findings, including a strong continued demand for ‘circular’ feedstuffs for all types of livestock.

IFEEDER (the Institute for Feed Education and Research) was established almost 15 years ago by the American Feed Industry Association and its associates, to connect private feed firms, academics and government agencies in supporting research and education towards a sustainable feed and pet food supply chain. In addition, IFEEDER spokesperson Victoria Broehm notes that IFEEDER is currently funding an assessment of the potential impact of disruptions within the vitamin and amino acid supply chain, “whether geopolitical, environmental, economic or logistical.” This project’s team is looking at scenarios where major vitamins (A, D, E, B Complex) and amino acids (lysine, methionine, threonine and tryptophan) are reduced in availability by various percentages, and the resulting effects on livestock production parameters such as growth rates and feed efficiency.

New project boosts LCA accuracy

Another IFEEDER project currently concluding focuses on how to improve feed ingredient Life Cycle Assessments (LCA). It is mainly funded by the United Soybean Board. This project’s team is assessing a method “for developing a robust and consistently-current dataset” to enable more-accurate LCA evaluations. It is expected that this project will also highlight the benefits of using US soybeans, maize and wheat in reducing the footprint of the feed industry (greenhouse gas emissions, water use and land use) compared to using such feedstuffs produced in other countries.

Feed ingredient consumption report

Returning to the feed report, there’s yet another update, with the last report released in 2020 based on 2019 data. IFEEDER is also about to release an update of its Pet Food Report. Again, the feed report investigated how much feed, what specific components and categories (such as circular and non-circular) components were consumed by different types of US livestock in 2023, adjusting for regional feed differences and life stages.But with each iteration of the report, more data is added.

Broader range of ingredients studied

As Spencer Parkinson (president of the consulting firm that completed both the most-recent and 2019 report) explained, “we’ve started to study additional ingredients. We were looking at 48 ingredients and we now have about 70.” These include rye in the small grains category, and non-corn brewer’s products and wheat gluten meal in the plant-based meal category. Wheat flour, sugar beef pulp, citrus pulp, peanut hulls, alfalfa meal and molasses are now included in the processed co-products category.

In addition, several new oils and fats added to the analysis in the latest report: corn crude oil, distiller corn oil, poultry fat, used cooking oil and canola oil. A new synthetic amino acid was also added, valine, and in the vitamins and minerals category, sodium bicarbonate.

“And so we are much more granular now in terms of the number of ingredients and the types of ingredients that we’re looking at,” said Parkinson. “The other thing that has changed over the years is how we’ve studied each individual species. For example, we have broken out beef cattle, for example, more finely. We’re now looking at different phases of production and we’ve done the same for dairy cattle and a few others. And we’ve had experience to guide us to ask different, better questions, to help us better define what some of the overall inclusion rates are and what are the overall feeding rates of ingredients.”

Feed report adds more ingredients

In the latest report, it was found that all US livestock, poultry and aquaculture consumed nearly 284 million tonnes of feed in 2023.

US livestock consumed 284 million tonnes

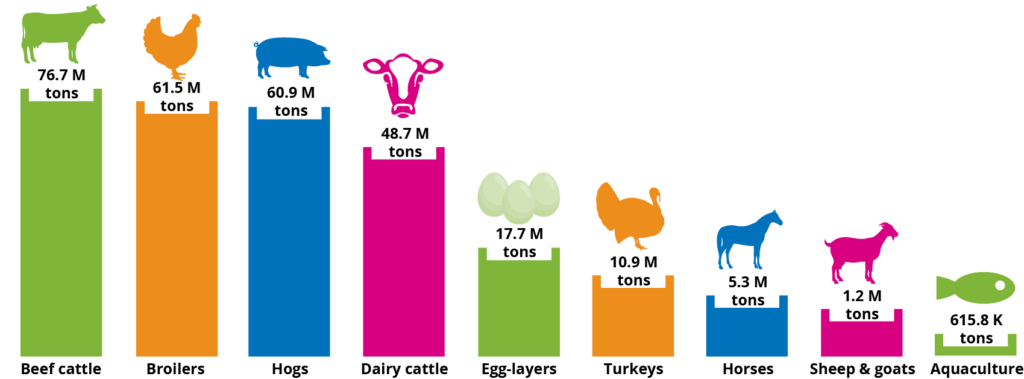

Iowa topped all other states, using 29 million tonnes of feed, followed by Texas, Nebraska, North Carolina and Kansas. Of livestock types, beef cattle consumed almost 77 million tonnes, broiler chickens next at about 62 million tonnes and pigs close behind at 61 million tonnes (Figure 1).

Figure 1 – In 2023, nearly 284 million tons of animal food were consumed by domestic livestock, poultry and aquaculture.

Corn dominates US compound feed

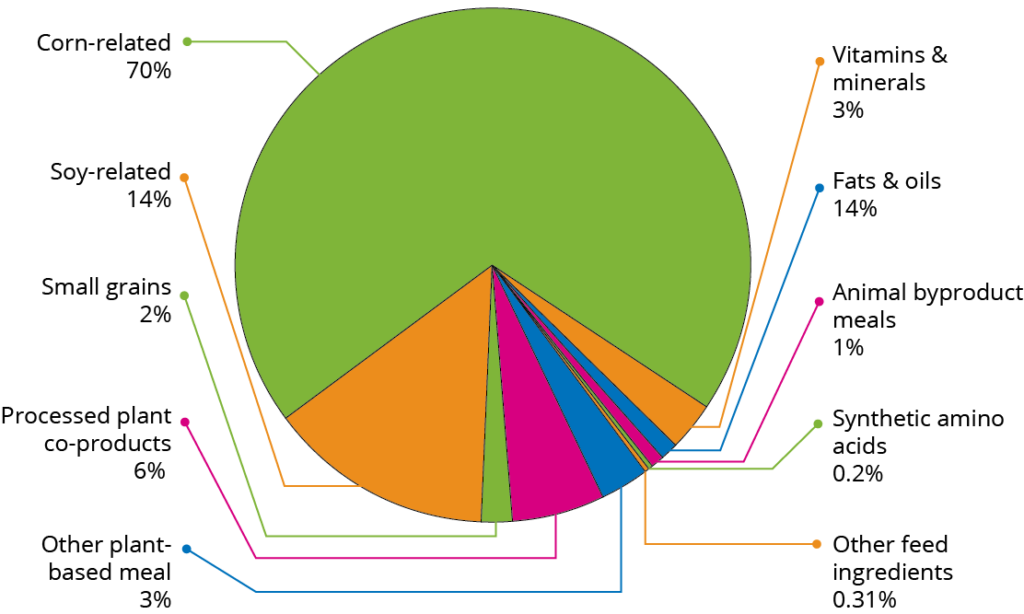

It’s no surprise that corn and corn-related products such as cornmeal and circular ingredient distiller’s dried grains (DDGs) make up the vast majority (70%) of the total amount of compound feed in the USA, followed by soybean ingredients at 14% (Figure 2). Other main US compound feed components include other plant-based meals, small grains, animal byproduct meals, fats and oils, synthetic amino acids, minerals and so on.

Figure 2 – Total animal feed consumption (without harvested forages).

Circular ingredients make up 37%

For many years, US feed mills and rendering facilities have worked with food processing and ethanol production plants to include their by-products in feed. In 2023, 37% of total feed consumption (excluding harvested forages and roughages) came from these circular ingredients, down slightly from several years before. As explained in the report, “circular ingredient consumption decreased by 3.7% (from 110 million tonnes in 2019 to 106 million tonnes in 2023) while non-circular ingredient consumption increased by 7.6% (from 165.0 million tonnes in 2019 to 177.6 million tonnrs in 2023).” Aquaculture species and horses lead the livestock types consuming the most circular ingredients (see Figure 3).

Figure 3 – Circular ingredients by species.

Horse feed trends shift circular

Horses appear to buck the trend of the overall small decline in US livestock consumption of circular ingredients, but this is because of a new circular ingredient now being included in the report that wasn’t there before. That is, in 2019 US horses consumed a circular:non-circular feed ingredient balance of 69:31% while in 2023, this ratio had increased to 77:23. So, while horse consumption of soybean meal declined by 43%, as did consumption of the (circular ingredient) DDGs by 59%, the circular ingredient soy hulls was now included, which is significant. It was determined that in 2023, 336,789 tonnes of soy hulls went into US horse diets.

Rendered ingredient use declines sharply

As is the case elsewhere, there is a third to a half (by weight) of each slaughtered US livestock animal that does not enter the human food chain. Rather, it goes into inedible products like tallow, but of course also into pet food and livestock feed after safe processing.

Interestingly, the new IFEEDER feed report shows however, that “the overall volume of rendered ingredients for livestock, poultry, and aquaculture declined from 9.75 million short tons (a unit of 2000 pounds) in 2019 to 5.28 million short tons in 2023.” That is a drop of 46%.

Biofuels impact rendered fats availability

One reason for this is that there’s been a boost in how much of livestock carcasses can be used for human consumption. However, the largest reason for the drop in the use of rendered feed ingredients is a drop in rendered fats used for feeds, due to a combination of both national and international factors.

There have been “increases in biofuels and renewable fuels production, increased export of products, and steep increases in fats and oils prices, nearly doubling in 2022,” state the report’s authors, “which have been coming down since but temporarily affected the use of fat in feed rations.” There were also changes over the last few years in the level of imports of used cooking oil and trade issues with used cooking oil. Lastly, shifts in the inclusion rates of soybean meal and DDGs in rations have also affected the inclusion rates of oils in US livestock rations in recent years.

Expect more IFEEDER reports this year, including those on pet food, LCA, amino acid and vitamin supply chains, and pig feed.